Investment Plan

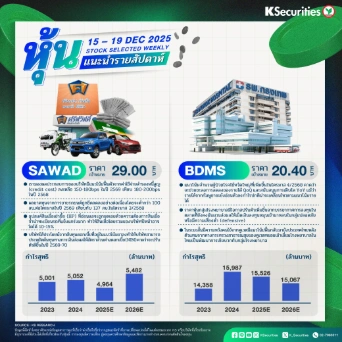

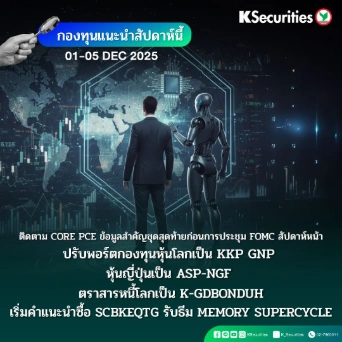

15 - 19 December 2025

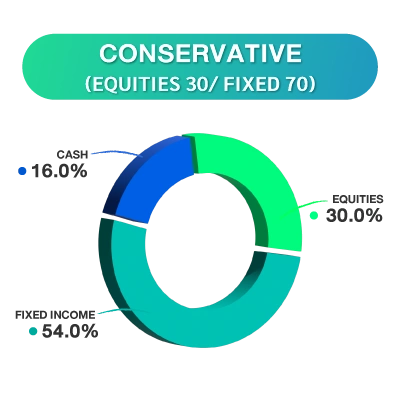

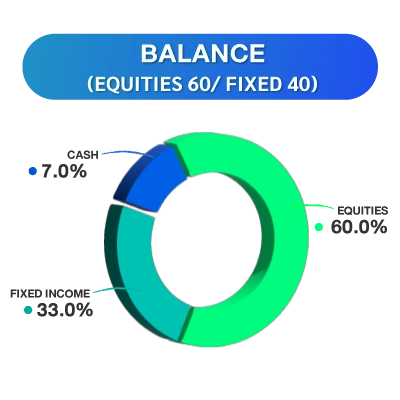

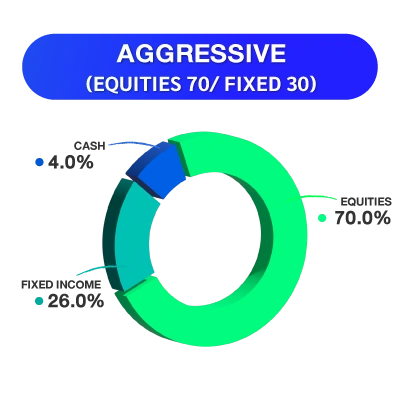

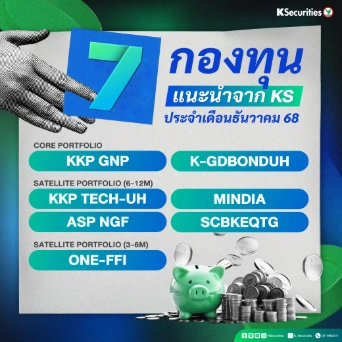

KS ASSET ALLOCATION

📌 Fed supports a Goldilocks outlook — accelerating GDP growth with inflation nearing its peak.

Buy on dip in tech stocks: earnings misses were driven by supply constraints, while demand remains strong.

🌍 Global equity markets were supported by the FOMC meeting, as the Fed cut rates by 25 bps and reaffirmed that rate hikes are not the base case, while revising 2026 GDP forecasts upward and inflation lower, reinforcing a Goldilocks scenario 🍯📈. Additional liquidity from T-bill purchases also supported risk assets. However, markets turned volatile late in the week due to sell-offs in tech stocks 📉 after Oracle’s earnings missed expectations and uncertainty around AI revenue visibility, pressuring the Nasdaq, while U.S. cyclical and small-cap stocks continued to outperform.

🌏 North Asian markets rose in response to the FOMC 🇯🇵🇰🇷, while Chinese equities remained under pressure from gradual stimulus measures 🇨🇳. India stayed volatile due to currency weakness, though medium-term earnings outlook remains positive 🇮🇳.

💡 Investment strategy: Recommend buying on dips in global equities as the core portfolio 🌐, with a focus on U.S. tech, Japan, India, and South Korea, benefiting from the AI and memory cycle 🤖💾.

💵 ONE-FFI: Wait & see amid FX volatility; set stop loss if THB strengthens below 31.50/USD.

🏦 U.S. financial stocks: Let profits run.

ภาษาไทย

ภาษาไทย

English

English