|

SSF Underlying |

Minimum Contracts |

14 SSF (Exclude KBANK) :

ADVANC, AEONTS, BBL, BH, CBG, CPALL, CPN, DELTA,

EGCO, KKP, PTTEP, SCB, SCC, and TISCO

|

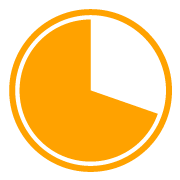

20 |

50 SSF :

AMATA, AOT, BA, BAY, BCH, BCP, BDMS, BGRIM, BJC, BLA, CENTEL, CK, COM7, CPF, CRC, GFPT, GPSC, GULF, HANA, ICHI, IVL, JMT, KCE, KTB, KTC, M, MAJOR, MBK, MEGA, MINT, MTC, OR, OSP, PTT, PTTGC, RATCH, SAWAD, SCGP, SPALI, STA, TASCO, TCAP, THCOM, THG, TOA, TOP, TQM, TRUE, TU and TVO

|

100 |

53 SSF :

AAV, AP, AWC, BAM, BANPU, BCPG, BEC, BEM, BPP, BSRC, BTS, CHG, CKP, EA, EASTW, EPG, ERW, GLOBAL, GUNKUL, HMPRO, IRPC, JAS, LH, LPN, ORI, PLANB, PRM, PSH, PSL, PTG, QH, SAMART, SGP, SIRI, SPCG, SPRC, STECON, STGT, STPI, THAI, THANI, TKN, TPIPL, TPIPP, TTA, TTB, TTCL, TTW, UNIQ, VGI, VNG, WHA and WHAUP

|

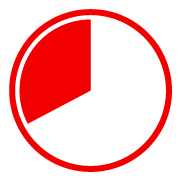

500 |

6 SSF :

BEAUTY, BLAND, ITD, RS, S, SUPER

|

1000 |

ภาษาไทย

ภาษาไทย

English

English