Investment Plan

16 - 20 February 2026

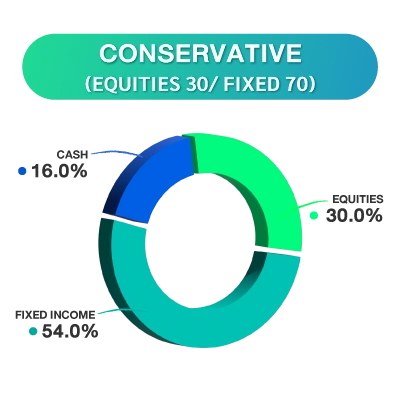

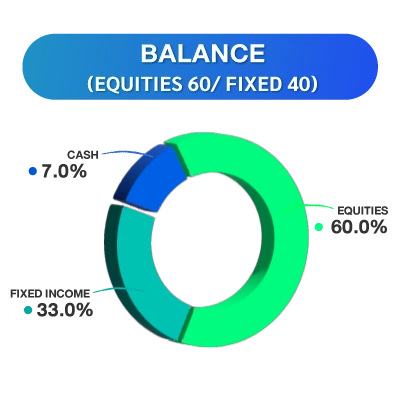

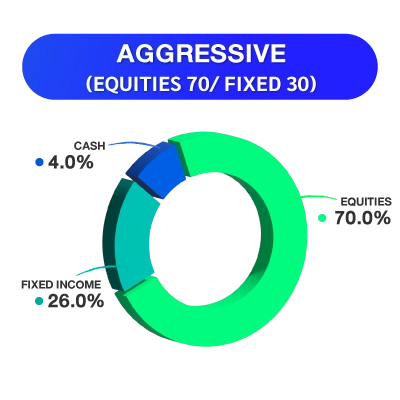

KS ASSET ALLOCATION

📌 AI supply chain stays hot. Watch TSMC acceleration, the Takaichi–Ueda meeting, and the U.S. Supreme Court ruling.

🌎 Last week, MSCI ACWI slipped 0.23% with sector rotation across regions. North Asia outperformed, led by KOSPI +8.21% on the HBM theme as Samsung Electronics accelerated shipments. TWSE rose 5.74% after TSMC posted record January revenue. 🇯🇵 Japan gained on expectations of proactive fiscal support, while the U.S. weighed on global returns, with the S&P 500 down 1.39% amid labor data and Fed signals, even as inflation continued to ease 📉.

💡 We maintain a preference for large caps to limit volatility. For core positioning, gradually accumulate global equities and global bonds while the 10Y yield remains above 4% 📌. For a 6–12 month satellite allocation, favor U.S. tech, Korea, Japan, and India on AI momentum and fiscal tailwinds 🚀. China tech is a wait-and-see after the index broke below key ranges ⚠️.

ภาษาไทย

ภาษาไทย

English

English