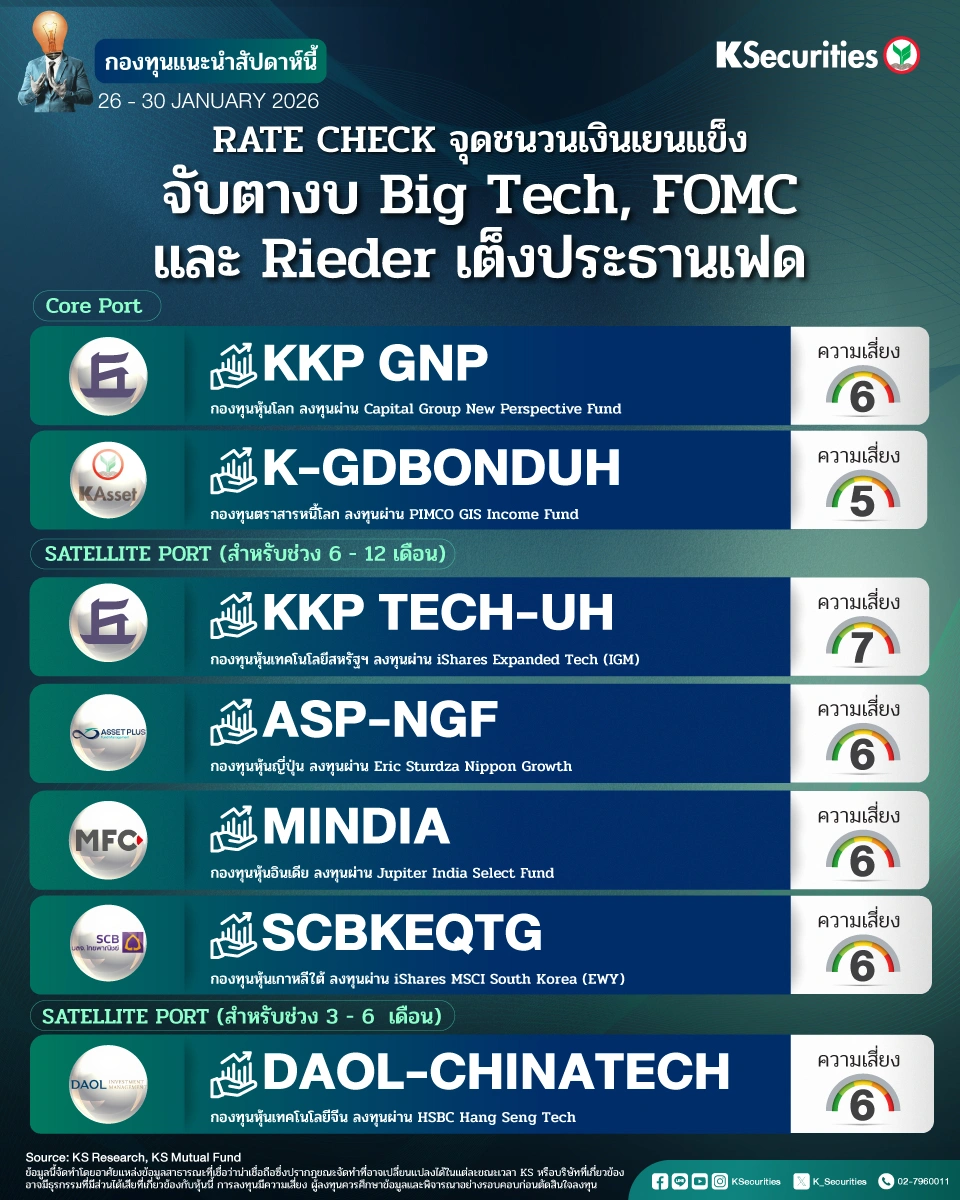

Investment Plan

26 - 30 January 2026

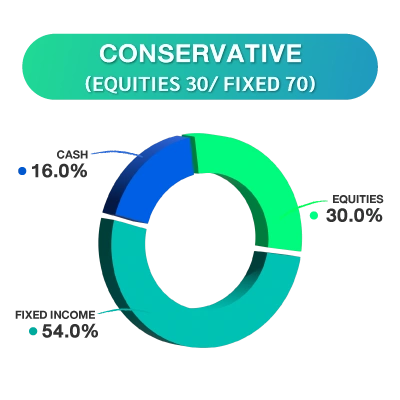

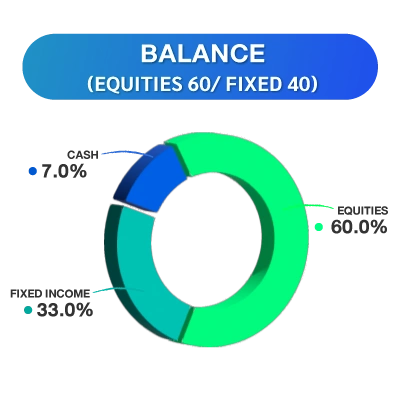

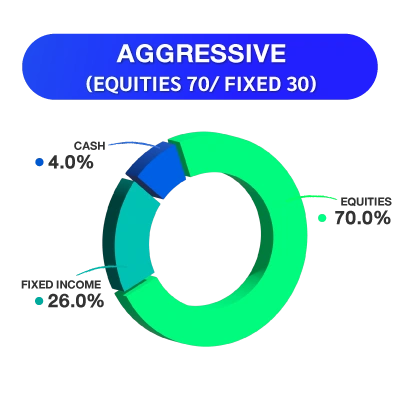

KS ASSET ALLOCATION

📌Rate checks spark a stronger yen; watch Big Tech earnings, the FOMC, and Rieder as a leading Fed chair candidate

🌍Global equities (ACWI +0.11%) remained highly volatile amid geopolitical risks and monetary policy uncertainty. Early in the week, markets were pressured by U.S. threats to impose tariffs on Europe if negotiations over Greenland fail to make progress, alongside uncertainty over the next Fed chair. These factors weighed on sentiment and pushed the U.S. 10-year Treasury yield up to 4.30%, pressuring risk assets.

Midweek, sentiment improved after Trump signaled at Davos a preference for negotiations rather than force, and as talks with NATO showed progress, helping ease tensions. Strong U.S. economic data (final 3Q25 GDP, initial jobless claims, and Core PCE) supported the soft-landing narrative, leading yields to ease and capital to rotate back into large-cap technology stocks. This marked a shift from small caps back to Big Tech. Meanwhile, the Japanese yen turned volatile after the BOJ flagged inflationary pass-through from yen weakness, and reports of “rate checks” raised speculation of potential FX intervention.

Overall markets mostly declined. India underperformed sharply on tariff concerns and negative news surrounding the Adani Group. Europe was pressured by tariff risks, while China and Japan traded sluggishly. In contrast, South Korea and Taiwan outperformed on strength in AI semiconductor and automotive stocks. U.S. markets were mixed, with Financials acting as a key drag.

💡Investment view: We remain constructive and see volatility as an opportunity to accumulate. Maintain global equities as a core allocation, and add satellite exposure to the AI theme via U.S. technology, South Korea, Japan, India, and China tech on market pullbacks 📊✨

ภาษาไทย

ภาษาไทย

English

English