Investment Plan

22 - 26 December 2025

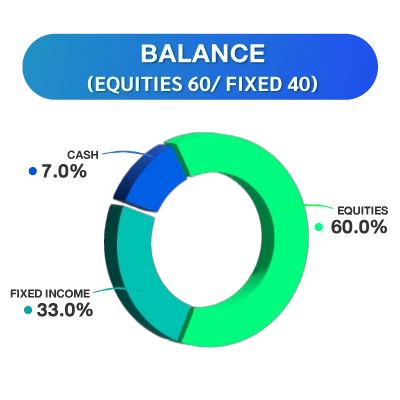

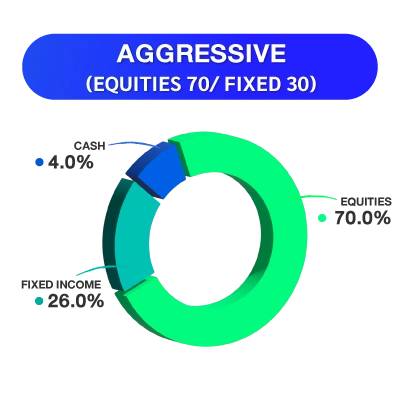

KS ASSET ALLOCATION

📌 From Tech Selloff to Tech Rotation after Micron delivered strong earnings. Core CPI hit a 4-year low, reinforcing expectations of additional Fed rate cuts in 2026.

🌍 Global equity markets remained volatile following the Tech Selloff triggered by Oracle and Broadcom earnings. However, sentiment improved toward the end of the week after Micron posted results far above expectations 🚀, confirming strong demand from AI and Data Centers. This was further supported by U.S. Core CPI at 2.6% YoY, the lowest level in four years 🔻, strengthening the outlook for Fed rate cuts in 2026.

🇺🇸 U.S. equity markets ended the week mixed, reflecting a rotation back into technology stocks 💻. Meanwhile, 🇪🇺 European equities reached all-time highs, led by the financial sector 💰. Japan, South Korea, and Taiwan declined earlier in the week but rebounded toward the end 📈. China was pressured by weaker-than-expected economic data, while 🇮🇳 India traded sideways amid uncertainty surrounding trade negotiations.

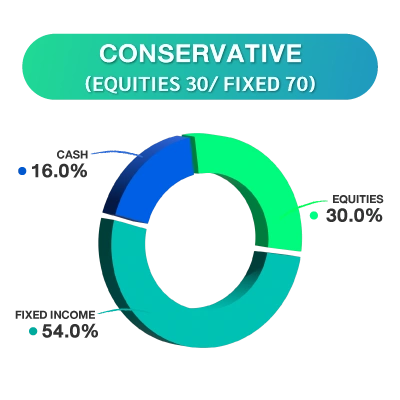

📊 Investment strategy: Gradually accumulate Global Equities (KKP GNP) as a core portfolio, and add Global Bonds (K-GDBOND-UH) when the U.S. 10Y yield approaches 4.20%.

⭐ 12-month Satellite Portfolio: Recommend KKP TECH-UH, ASP-NGF (Japan), MINDIA (India), and SCBKEQTG (South Korea), driven by the AI theme and the Memory Super Cycle.

⚠️ Short-term view: Recommend cutting losses on ONE-FFI after the Thai baht appreciated beyond 31.50 THB/USD.

🔎 Key factors to monitor: U.S. GDP 3Q25, CB Consumer Confidence, China’s NPC meeting, BOJ meeting minutes, and Tokyo inflation data.

ภาษาไทย

ภาษาไทย

English

English